Back

27 Jan 2020

Gold Price Analysis: Bears seek 5 wave correction to 61.8% Fib retracement

- Gold has popped in the stat of the weel's Asian session, with risk-off themes fueling the bid.

- The price may be completing a 5 wave scenario and could be subject to a bearish correction.

- The 61.8% Fibo and weekly support in the low 1500s could be on the cards.

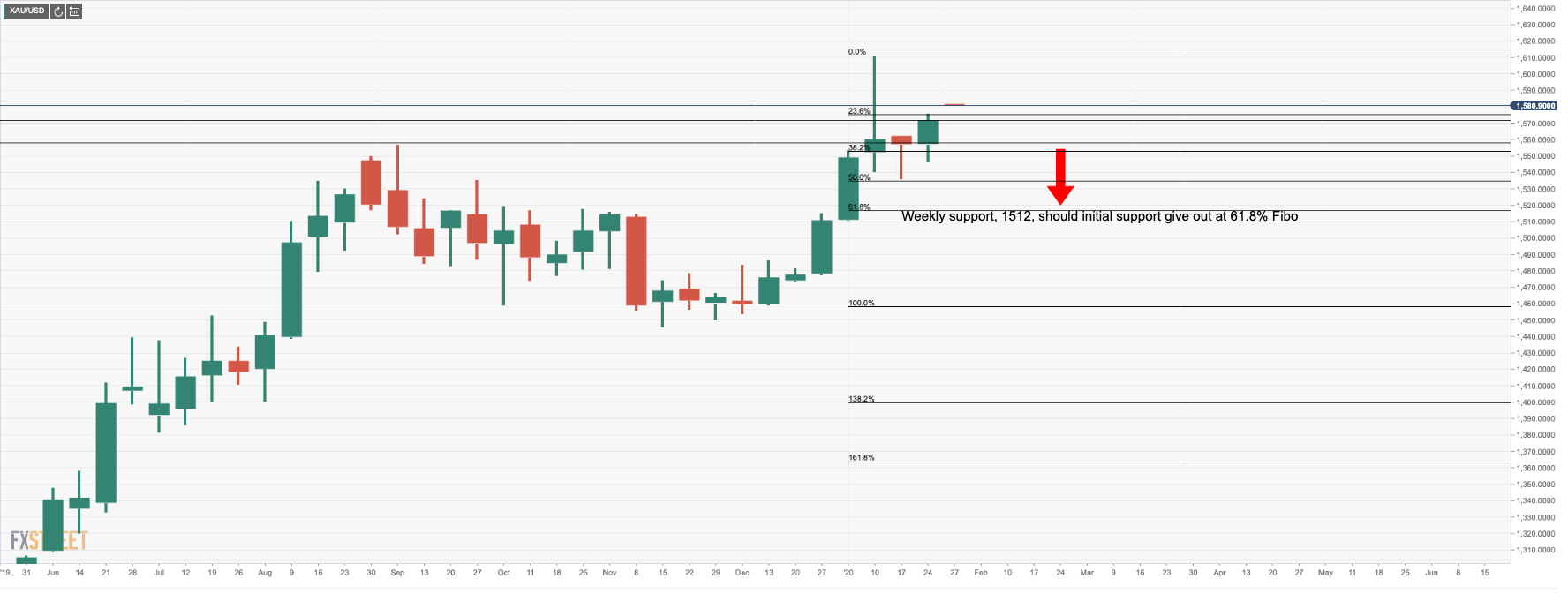

Gold daily chart opening gap, the downside correction target

Gold daily chart, weekly support and confluence with 61.8% Fibo

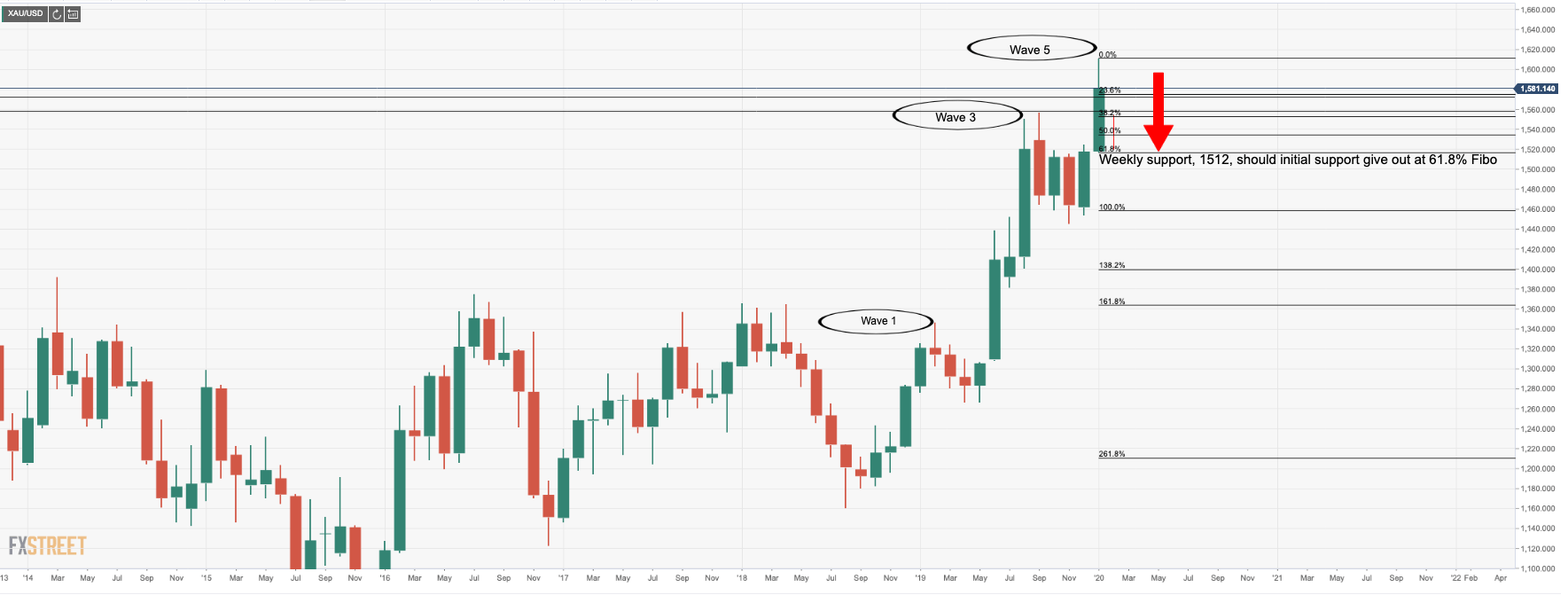

Gold daily chart, 5th wave bearish correction to 61.8% Fibo target scenario

The price of gold has been climbing in five waves on the monthly charts and could be on the verge of a correction. However, considering the geopolitical environment as well as the risks of a global pandemic of the Coronavirus, it could be prudent holding off at this juncture from positioning any shorts. Instead, it may be a higher conviction trade to look for a bullish entry point maked by the opening gap. Failures there opens an opportunity to get long down in the 61.8% Fibonacci retracement of the monthly impulse from the 1460s.